Distribution

Centralized Distribution

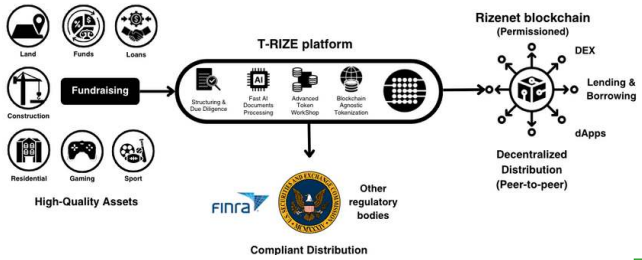

T-RIZE employs a centralized distribution model through partnerships with SEC-registered broker-dealers, ensuring the compliant issuance and distribution of tokenized assets in the U.S. and global markets. This approach provides a regulated, secure trading environment aligned with stringent U.S. securities laws, offering institutional and retail investors a reliable entry point into the tokenized asset market. To maintain global regulatory compliance, T-RIZE adapts its distribution framework to meet the requirements of each jurisdiction, ensuring full adherence to regional financial regulations.

Future developments in decentralized distribution

T-RIZE is also planning to expand into decentralized solutions to fully leverage the potential of blockchain technology. The initiatives include deploying a decentralized borrowing and lending protocol on the Rizenet blockchain, collateralized with security tokens, and integrating with established DeFi protocols on Base and other supported blockchains, enhancing overall DeFi capabilities. All of this is set within compliant, permissioned blockchain structures designed to maintain regulatory compliance while providing the core benefits of decentralized finance, such as transparency, immutability, and reduced counterparty risks.

Additionally, we also plan to integrate with decentralized exchanges (DEXs) to enhance the liquidity and accessibility of tokenized assets. This integration will facilitate peer-to-peer transactions without intermediaries, aiming to significantly enhance market efficiency and accessibility. By leveraging DEXs in the future, we intend to provide investors with direct engagement in the market, offering them more control over their transactions and reducing the friction typically associated with traditional exchanges. The planned introduction of dApps will further enhance the T-RIZE platform’s capabilities, offering sophisticated, blockchain- based tools for user interaction, investment and asset management.

Synergistic Approach

The dual strategy of utilizing both centralized and decentralized distribution methods allows T-RIZE to offer a comprehensive suite of services that cater to a diverse range of investor needs. By providing options for both highly regulated, secure transactions and more open, flexible trading environments, we bridge the gap between traditional finance and the evolving world of digital assets. This hybrid approach not only increases the platform's resilience and appeal but also ensures that it is well-positioned to adapt to future regulatory and technological changes.